Top 12 Finance loyalty programs in Europe

26 November, 2025

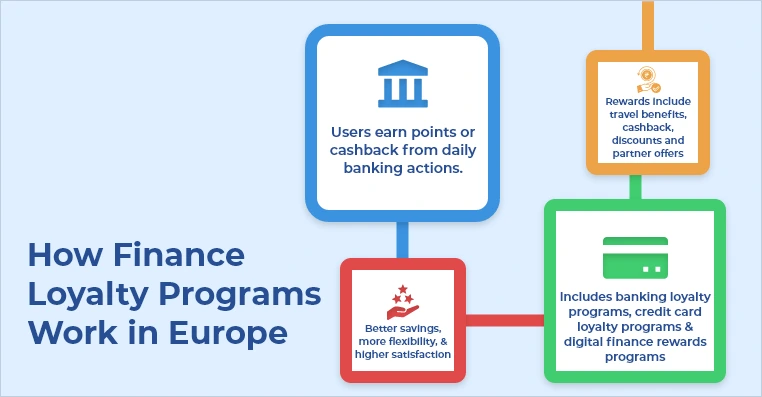

The way people think about banking has undergone a complete transformation. Customers are no longer satisfied with basic services. They expect real value, useful rewards, and a relationship that feels personal. This shift has made finance loyalty programs more important than ever. Today, many banks and fintechs offer finance loyalty programs in Europe that reward simple daily actions like saving, paying bills, or choosing digital banking. These financial reward programs help people get more value from the same financial habits. Modern financial rewards programs are not just about collecting points. They make everyday banking easier, smoother, and more rewarding. As credit card loyalty programs, mobile banking perks, and the best loyalty programs for financial products continue to grow, customers now look for banks that appreciate their loyalty. This list highlights the strongest finance loyalty programs in Europe and shows how each one improves the banking experience. Type: Banking loyalty program Website: santander.com How It Works: Earn Avios whenever you make deposits, pay bills, or use your card. Why People Love It: Everyday spending turns into travel rewards. Why It Matters: One of the most popular finance loyalty programs in Europe, offering a mix of lifestyle and financial rewards. Type: Credit card loyalty program Website: all.accor.com How It Works: Earn points on your Santander card and redeem them for hotels, shopping, and experiences. Why People Love It: Simple, flexible, and easy to understand. Why It Matters: A strong example of finance rewards programs designed for everyday users. Type: Digital banking rewards Website: bbvaspark.com How It Works: Rewards and partner perks are given for using digital banking services. Why People Love It: Digital convenience with real value. Why It Matters: A growing part of finance loyalty programs in Europe that encourages online banking. Type: Savings rewards Website: bbva.com How It Works: Monthly savings unlock bonuses and small financial rewards. Why People Love It: Encourages responsible saving habits. Why It Matters: Shows how financial rewards programs can support long-term financial wellness. Read more - Top 20 Finance loyalty programs in the Pacific Type: Digital banking perks Website: n26.com How It Works: Cashback and partner discounts appear directly inside the N26 app. Why People Love It: No points. No tracking. Just instant rewards. Why It Matters: A mobile-first model that defines many new finance loyalty programs in Europe. Type: Fintech loyalty program Website: revolut.com How It Works: Cashback, travel rewards, and brand offers based on your membership plan. Why People Love It: Designed for modern digital users. Why It Matters: Combines finance rewards programs and credit card loyalty programs in one app. Type: Banking loyalty program Website: trueloyal.com How It Works: Earn points for online payments, paperless banking, and digital activity. Why People Love It: Makes digital banking more rewarding. Why It Matters: A strong example of financial rewards programs that support greener habits. Type: Credit card and travel rewards Website: norwegianreward.com How It Works: Earn CashPoints on daily spending and redeem for flights or seat upgrades. Why People Love It: Simple, clear, and ideal for frequent travelers. Why It Matters: A leader among credit card loyalty programs in Europe. Type: Business finance rewards Website: mastercard.com How It Works: Businesses earn cashback or points on company payments. Why People Love It: Helps reduce costs through daily spending. Why It Matters: One of the best loyalty programs for financial products is created for business owners. Read more - Top 10 Restaurant Loyalty Programs in Europe Type: Green banking rewards Website: abnamro.com How It Works: Rewards are given for choosing eco-friendly banking options. Why People Love It: Encourages sustainable financial decisions. Why It Matters: Shows how finance loyalty programs and environmental goals can work together. Type: App-based loyalty ecosystem Websites: monzo.com, bunq.com, curve.com How It Works: Cashback, spending insights, and premium upgrades through subscriptions. Why People Love It: Fast, simple, and built for digital lifestyles. Why It Matters: One of the fastest-growing areas in finance loyalty programs in Europe. Type: Regional financial loyalty trends Website: marketresearch.com How It Works: Gamified savings goals, mobile rewards, and AI recommendations. Why People Love It: Highly personalized and easy to use. Why It Matters: A look at the future of finance rewards programs and the best banking rewards cards 2026. Finance loyalty programs are now a major part of how people choose banks, cards, and digital financial services. The top finance loyalty programs in Europe show that rewards do not need to be complicated. They need to be useful. Whether it is cashback, travel benefits, digital perks or sustainable rewards, these finance rewards programs and credit card loyalty programs prove that every customer can earn value through simple everyday actions. As the best loyalty programs for financial products continue to grow, customers can expect more personalization and better value. And with the rise of the best banking rewards cards 2026, the future of financial rewards programs looks even stronger.

1. Santander One Iberia Plus

2. Santander Esfera

3. BBVA Spark Rewards

4. BBVA Savings Incentive Program

5. N26 Perks

6. Revolut Rewards

7. Deutsche Bank Express Rewards

8. Bank Norwegian Norwegian Reward

9. Mastercard Business Bonus Ultimate

10. ABN AMRO Sustainable Banking Rewards

11. Fintech Rewards Ecosystem (Monzo, Bunq, Curve)

12. Pan-European Digital Loyalty Models

Conclusion